Fintech industry in India has witnessed nothing short of a miracle with its ever-expanding consumer base. Two business prodigies – Aditya Birla Capital Ltd. and Ashneer Grover have seek to leverage the opportunity the industry entails.

BharatPe cofounder Ashneer Grover is set to unveil his plans targeting the healthcare infrastructure in India. His plan commemorates the development of a new application called ‘ZeroPe’ which incorporates hassle-free medical services.

The formerly sacked employer of BharatPe, Ashneer Grover often in his interviews reinforced India’s fintech credibility, inspiring him to collaborate with Non-Banking Finance Company (NBC) to facilitate pre-approved loans of up to Rs. 5,00,000 to help people cover their medical expenses. The application will exercise plans based upon personalized needs and requirements.

Among many who have ventured into India’s rapidly accelerating Fintech industry, only few have accumulated a strong customer support. The sun shone for those who already had assumed control in other multifaced business opportunities. Aditya Birla Group – an Indian multinational conglomerate has leaped into the fintech forum.

Aditya Birla Capital Ltd is set to launch its mega direct-to-customer business app – ABCD – on April 16th offering various financial products on a single digital platform. The app will enable customers to engage in multidisciplinary transactions from investments to insurance.

Will the fintech industry undergo a ‘financial earthquake’?

The economic consequences which India will face once the applications are dispatched for consumption are going to be handful. It will terrorize competitors who have tried to make a mark in an already competitive environment.

But it will also produce quality services which consumers prioritize more than anything. The monotony which has steeped deep into India’s fintech world derailing organizations from innovation will revamp their hunger to compete, innovate and produce.

The huge-investment adventure which companies like Aditya Birla Group can undertake will rejuvenate the overall health of the industry – it will improve its structure, reshape its regulatory framework, employee skill-based workforce and empower others to move on their footsteps.

Since his exit from BharatPe, Ashneer has mastered the act of enticing young-youth of India through his ever assertive disposition. Headstrong with his opinions, Grover has used his failures to empower young minds, inspiring them to keep their feet away from the brakes.

If anything, the financial earthquake will reverberate through urban and rural pockets, campaigning for more people to come forward and leverage the opportunities which the fintech world has to offer.

How has Fintech in India been significant?

A population of 1.4 billion people have either directly or indirectly impacted by the explosive growth of digitalization in the country. Fintech has enabled people to keep a regular track of their finances with regulations in place to address customer grieviances.

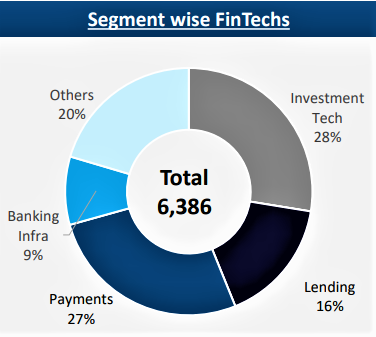

The prediction hypothesize a steep growth in India’s fintech market which is expected to grow four-times in the next five financial years. The graph reflects the untapped potential the Fintech market in India continues to have and how new players in the market will necessitate a much forceful change.

India’s GDP, a sizeable part of which is directed by consumption industry has transformed drastically since the inception of Unified Payment Interface (UPI), a faster payment gateway. Street vendors, small business owners, big enterprises, personal households have all registered in wholesale to acquire services for faster transactions, financial security and speedy business operations.

Applications concerned with investments have been developed to help people understand the stock market and how it can be a high-yielding financial instrument.

On one side, companies like Visa and Mastercard have deployed measures to reduce financial monopoly and reinforce public confidence in other financial enterprises, India has welcomed multicultural engagement in the Fintech industry.