Uber, an e-mobility app reported “below-expectations” Q1 result. Weaker ride demand in consequence to stiff competition was outlined a main contributor

The ride-hailing app, Uber Technologies’ which was founded in 2009, reported slight under-performance than what shareholders expected. Uber’s gross bookings, which is the total amount of money Uber collects from ride, meal delivery and freight shipment, rose 20% to $37.7 billion from previous year – slightly below analyst’s expectations.

The company reported a net loss of $654 million which is disturbingly weaker than the $157 million last year, disconcerting the investors. Uber C.E.O, Dara Khosrowshahi elucidated the reason behind this unsettling loss saying that “it had nothing to do with the operating business.” The $654 million net loss, or a 32-cent loss per share, despite revenue jump of 15% from $8.82 billion last year to $10.13 billion in its first quarter has caused sinking share value.

Uber Technologies’ shares plunged -5.72% to 66.40 in premarket trading on Wednesday as the company released its first-quarter results. The company has been under pile of legal battles brought by Australian taxi-owners which Uber recently settled, while another litigation from London cabdrivers followed. These battles have added extra expense for the company in form of legal costs.

Weaker-than-expected performance as Uber experiments in diverse segments

Uber’s gross bookings weakened to $37.65 billion which was slightly below the $38.02 analyst’s expectations. The weaker ride demand in some parts of the world led to this shortfall. Lyft which is Uber’s main competitor reported higher-than-expected earnings on Tuesday amid stronger demand. The excessive mobility needs in the world has led to an outburst of countless e-mobility applications.

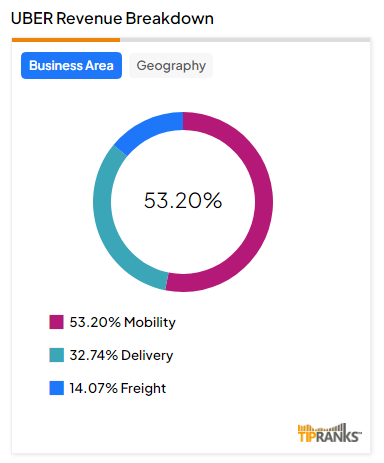

This irresistible competition has pushed Uber to experiment in different service sectors. The logistical challenges widened as Uber moved into other areas, like freight and food deliveries. Uber’s mobility segment reported $5.63 billion in revenue, up 30% from last year and 2% from quarter to quarter. Company’s delivery segment reported $3.21 billion in revenue, up 4% from previous year and 3% quarter to quarter, while the freight business booked $1.28 billion in sales, a decrease of 8% from previous year.

“To drive user growth and win more of their daily trips, we are focused on increasing our penetration of core use cases, while also expanding into new consumer segments”, Uber C.E.O expanded.

Weak gross bookings and revaluation of investments contribute to net loss

Uber’s earning per share was recorded at a loss of 32-cents per share when analysts were expecting a profit of 22-cents per share. The unrealized net loss was attributed to revaluation of Uber’s equity investments which the company C.E.O admitted drove Uber’s unsettling $654 million net loss.

Of the $4.0 billion which amassed to company’s first-quarterly gross profit, $3.8 billion were spent on operating expenses and the rest $200 million was its operating profit. Uber spent around $800 million on equity investments and company holdings which contributed to $654 million net loss. This splurge on equity investments had negatively impacted the company’s overall dividend submission to its key investors.

Monthly active users completing ride or delivery on its online platform increased to 149 million which was a 15% Y.O.Y jump. Total trips of 2.6 billion was recorded, a 21% Y.O.Y jump. For the current year, Uber projects gross bookings to fall $38.75 billion to $40.25 billion which would imply growth of 18% to 23% year-over-year. Analysts are looking for $40.12 billion in gross bookings in the upcoming quarter.

The growing economic uncertainty has plastered some of the biggest multinational companies including Starbucks which reported an unexpectedly weaker earnings in first quarter of this year. Uber too has initiated a plan-of-action as it ventures to partner with grocery delivery app – Instacart to bring Uber Eats restaurant delivery to the Instacart app in the coming weeks nationwide.

“Through this partnership, Instacart customers now have access to both best online grocery selection in the U.S. and restaurant delivery, making it even easier for them to tackle all their food needs from a single app”, Instacart Chief Executive Officer Fidji Simo said.