Berkshire Hathaway, Warren Buffet’s brainchild has over the years entailed enormous value to its shareholders. To discuss future business models, the company CEO will chair its annual shareholding meeting, also deliberating on its future heir

A crew of billionaire business minds would be seen hopping in their private charters to make their speedy attendance at the annual Berkshire’s shareholder meeting in Omaha, Nebraska on May 4th. The flock of wealthy investors would be expecting Buffet to headline some of the most important economic challenges, stagnating the company’s overall expansion.

Through the years, twin runners of the business conglomerate, Warren Buffet and Charlie Munger have educated at-home audiences with their exemplary take on mindful investments during shareholder meetings, broadcasted live. But this year’s event will be the first without Charlie Munger, who died in November, at age 99 – swirling speculations about Berkshire post-Buffet, who is 93.

Buffet appointed Greg Abel as his successor C.E.O, who is Berkshire’s vice-chairman and head of the conglomerate’s noninsurance operations. Shareholders will be “all-ears” to listen Abel’s standpoint on company’s future and his list of strategies to bolster Berkshire’s operations ahead of Buffet’s absence.

Investor expectations from Warren Buffet’s annual meeting

In Buffet’s annual letter to shareholders, Buffet mentioned key challenges to Berkshire’s business empire, including weakening shipment volumes, and tightening fiscal policies. The company’s stock outperformed some of the biggest publicly-traded giants including Apple, Microsoft, Tesla, as well as the S&P 500. But with the interest rates remaining higher which has distressed global investors as consumer spending descends, shareholders will want to know where Warren sees future opportunities.

Attendees would also be curious to unearth post-Buffet’s investment projects which the C.E.O. has said, “All in all, we have no possibility of eye popping performance.” This statement was made to aware people about how big Berkshire has become and that it is unlikely that it will find any major acquisitions in the future. This particular epilogue might have teleported future successor in a state of dilemma, as he prepares to slip himself in shoes of ever-legendary, Warren Buffet.

Another source of excitement for shareholders would be unveiling of Buffet’s confidential wager which he has been making since the third quarter of last year. Keeping the stock in hiding has helped Buffet from driving up its price. The wager has been guaranteed against a financial firm, which his close associates believe is a multibillion-dollar wager. This analysis spawned from company’s $3.5 billion jump in the stocks owned in bank, finance and insurance sector. Wherever he has placed his bet, it will be a big booster for the company, given Buffet’s track record of identifying value.

Warren Buffet, living tycoon in investment banking

Unanimous public vote designates Buffet a revolutionary mastermind in identifying value of a company. His unmatched capability to distinguish good investment from bad is a life lesson for many. These early progressions have flagged Berkshire Hathaway as most successful publicly traded company in the world and it is all accredited to Buffet’s genius.

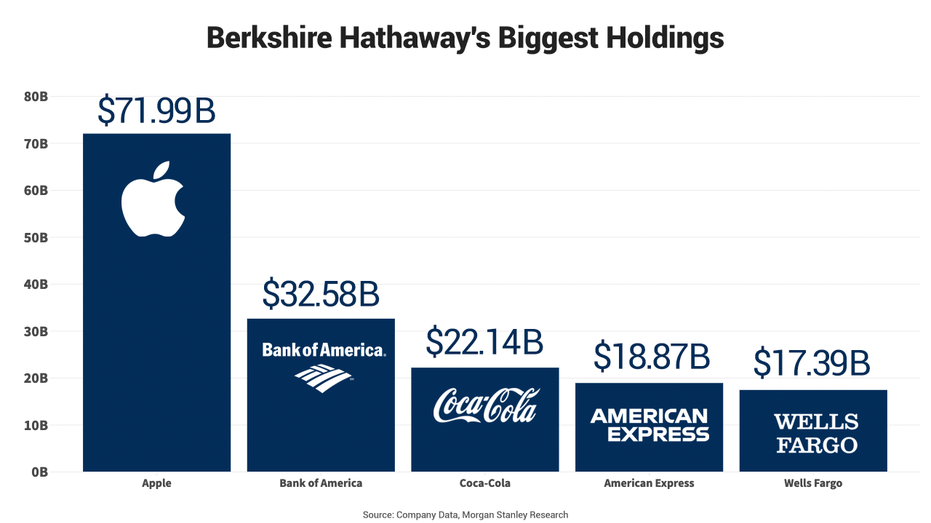

Him gulping on some of the biggest tech giants including Apple, whose stakes his company bought, around 6%, or 40% of conglomerate’s total value, making iPhone manufacturer, Berkshire’s largest public holding. Berkshire Hathaway’s operating profit during the first quarter jumped 39% to $11.2 billion, or about $7,807 per class A share, compared to $8.07 billion for the same period a year ago. “When you are GOAT of investing, people are interested in what you think is good,” said Glenview Trust Co. Chief Investment Officer Bill Stone, while referring to Warren Buffet.

Under Buffet, Berkshire has trashed the S&P 500 for nearly six decades. As Berkshire investors and fanboys of the 93 year old Warren Buffet are going to flood Omaha for the 2024 annual meeting. The company stock had the best day on Friday since 2022, largely due to a $110 billion stock buyback plan and increased margins that results from growing business services.