Hailed as a juggernaut in graphic processing unit (GPU) and computer chip designing and manufacturing, Nvidia has backed a split-scheme following its blockbuster stock performance

Nvidia announced a 10-for-1 stock split in its fiscal first-quarter earnings report on Wednesday. The chip magnate recorded revenue of $26.0 billion ended on April 28, 2024 on a quarter-to-quarter basis – up 18% from Q4 and up 264% from a year ago. The major contributor to Nvidia’s whooping business report has been its data center business that recording a banging 427% growth from previous year – accumulating a total of $22.6 billion in revenue, up 23% from Q4.

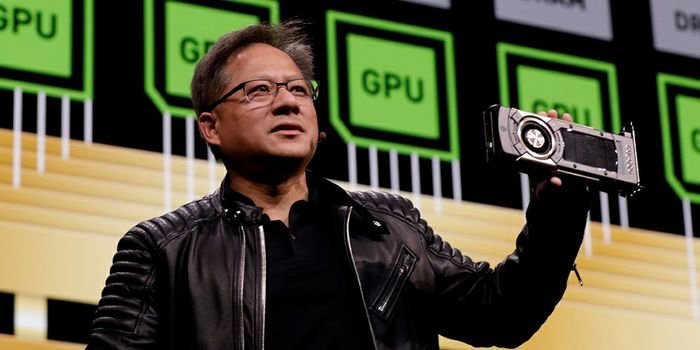

“The next industrial revolution has begun – companies and countries are partnering with Nvidia to shift the trillion-dollar traditional data centers to accelerated computing and build a new type of data center – AI factories – to produce a new commodity: artificial intelligence,” said Jensen Huang, founder and CEO of Nvidia. “AI will bring significant productivity gains to nearly every industry and help companies to more cost-and-energy efficient, while expanding revenue opportunities.”

Nvidia’s most important clients that make up 40% of Nvidia’s $22.56 billion in data center sales in the April quarter are the big cloud providers – Amazon Web Services, Microsoft Azure, Google Cloud and Oracle Cloud. Following Nvidia’s blockbuster earnings report on Wednesday, finance Chief Colette Kress told investors that cloud providers were seeing an “immediate and strong return on their investment” – If a cloud provider spends $1 on Nvidia hardware, it can rent it out for $5 over the next four years.

What is Nvidia’s 10-for-1 stock split ahead of its Q1 report?

After a soaring market report, Nvidia announced a stock-split scheme on Wednesday, which analysts claim do nothing to change the financial fundamentals of the company but they make price of each share cheaper which can have a positive psychological effect on retail investors. Nvidia said, “It will make ownership more accessible to employees and investors.”

Nvidia’s 10-for-1 stock split means shareholders will get ten shares for each one they held before the split. Nvidia shares closed on Wednesday at $949.50, with a split based on that price each share will cost $94.95, though an investor would have to buy 10 of them to own the same amount of the company as they currently get with one share. Another example – if Nvidia shares were trading at $1,000 before the split, an investor holding holding one share would hold 10 shares priced at $100 each after the split.

Nvidia investors have enjoyed a historic rally over the past five years, with the stock-price soaring 25 folds. The company was long known as the primary maker of advanced graphic processing unites (GPUs) for videogames, but has emerged of late as the central hardware player in the artificial intelligence boom. Revenue in Nvidia’s first quarter fiscal soared 262% from the earlier period, marking the third straight quarter of growth in access of 200%.

What good can a split do for investors?

Nvidia said that each holder of Nvidia’s common stock will receive nine additional shares of the common stock that will be distributed after market closes on Friday, June 7. Trading will commence the following Monday. This scheme could help investing in Nvidia comparatively more accessible to a wider range of investors and increase liquidity, as the stock’s price at over $1,000 could discourage some buying it.

Another reason some companies might undergo a stock split because the lower share price could help the company added to n index like Dow Jones Industrial Average which mostly refrains from adding high-priced stocks as movements in price could have an outsized impact on the index which currently consists of 30-indexes of blue chip companies.

The highest-priced stock in Dow were UnitedHealth Group at $516.51, Goldman Sachs at $457.94 and Microsoft at $427.37 of 2 p.m. on Thursday, well below Nvidia’s share price of $1040.55. Amazon joined the Dow earlier this year after undergoing a 20-for-1 stock split in June 2022.